Spend Visibility – A Game Changer!

- August 25, 2022

Index

- Overview

- Types of spend

– Direct Spend

– Indirect Spend

– Tail Spend

– Maverick Spend

- Spend Analytics- Why does it matter?

– Cost Savings

– Improved Working Costs

– Spend Transparency & Visibility

– Enriched Data

– Better Supplier Relations

– Break Away from Siloed Culture

– Future profitability

– Risk mitigation

– Compliance

– Reduced Cycle time - Challenges Ahead

– Lack of Resources

– Inconsistent data

– Lack of collaborative initiatives

– Lack of analytical skills

– Lack of support from authorities - Spend Analysis – Process

- Spend Cube

- Course of Action

– Tail spend analysis

– Vendor spend analysis

– Category spend analysis

– Item spend analysis

– Payment term spend analysis

– Control spend analysis - KPIs to Look Out For

– Quality KPIs

– Delivery KPIs

– Cost Saving KPIs - Components Of Spend Analysis

– Descriptive

– Prescriptive

– Predictive - Spend Forecasting

- Trend Analysis’ role in forecasting

- Invoice Analysis role’ in forecasting

– Demand Forecasting

– Cost Forecasting

– Currency Forecasting - Should Cost Modeling

- Market And Supplier Intelligence

- AI Changes the Paradigm In Spend Analysis

Spend Analysis provides a comprehensive picture of the organization’s total spending by extracting insights from the data. It aids the organization’s procurement procedures, which are dependent on expenditure data to function, and are executed successfully by making educated judgments during the strategic sourcing process.Spend Analytics, is the process of collecting, cleaning, categorizing and analyzing spend data. It provides visibility and transparency across the spend of the entire organization.Let’s start from the basics.

TYPES OF SPEND

There are mainly 4 spends that help boost the firm’s bottom line.

Direct Spend-- Purchases of raw materials and items directly from manufacturers are known as direct procurement (or “direct procurement” for short). The spend on these items are termed as direct spend and are a part of COGS.

- Costs that are directly associated with future sales are considered direct spend.For example, a cosmetic brand sourcing eye liner from one supplier and lipstick from another.

- Production and distribution companies and retail brands rely on ERP systems to gauge demand for their products and order the right amount of direct materials to fulfil it.

Indirect Spend-

- Any activity that has no direct connection to revenue is considered indirect. It’s common for them to appear on the income statement under the heading of operating expenses.For example, laptop or coffee machine for employees.

- Indirect expenses that can spiral out of control if a corporation doesn’t have stringent regulations in place to defend against overspending.

Tail Spend-

- Tail spend, aka, C-material spend constitutes 80-90% of purchased items-presumably low-volume, one-time or sporadic orders distributed to a diverse range of vendors.

- Notwithstanding, the vast number of products covered, it only amounts to 10-20% of the company’s total spend.

Maverick Spend-

- Such spending occurs when purchases are made outside of the organization’s procurement procedures. As a result of not involving procurement in the purchasing process, possibilities for price comparisons and discounts are lost, while the risk of non-compliance increases.

Expenses are initially classified by procurement specialists in order to have a complete picture of how their firm spends money. In the end, these categories account for the majority of the organization’s expenditures.

SPEND ANALYTICS- WHY IT MATTERS?

To build a single source of truth for your company’s spending, you can use a Spend Analysis Platform to gather and upload disparate data from disparate systems into a single database.

- Cost Savings

Many firms are on the lookout for possibilities to spend money in a productive way. But the only problem is that they are unable to spend since they do not have enough money in the bank to do so. Spend analytics helps them get insights in areas which could not have been possible manually and hence the increased savings.

“High-performing” procurement teams are formally judged on their ability to deliver cost reductions, more than any other KPI, according to the Deloitte Global Chief Procurement Officer Survey 2021 released in March of 2018.

- Improved Working Cost

A thorough review of spend can lead to a significant increase in working capital. When it comes to freeing up working capital, identifying categories and providers with payment terms that are lower than the agreement level is a great starting point.

- Spend Transparency and Visibility

When it comes to managing cash flow and working capital, a central spend database may help management make smarter investment decisions . Because everyone gets access to the same version of the spending data, it facilitates better dialogues. In the decision-making process, procurement spend analytics improves visibility and transparency. Procurement automation helps in optimum utilization of resources and gaining a better grasp of the spend.

- Enriched Data

Many companies face troubles because they lack the necessary data. As a result, they don’t have a complete picture of their spending. The ability to perform Spend Analytics in Procurement depends on the data in hand.

Once your data has been cleaned and categorized, you can verify that you’re utilizing supplier data to acquire competitive pricing by looking for trends.

- Better Supplier Relations

An organization’s expenditures with different vendors are one of the most important KPIs. CSR or the need to satisfy their major consumers are driving forces behind this. As well as helping to better understand spending with different suppliers, having all the data in one location also helps you build stronger relationships with suppliers that you may not have recognised accounted for such a major portion of your spending, and develop a better supplier management strategy.

- Breaking Away From Siloed Culture

This type of culture can be easily overcome by using an integrated spend analysis system that communicates with important tools of a business such as its ERP or accounting software. Each department can retrieve the reports they need from a central repository using these tools.

- Benchmarking Performance

Internal performance can be compared to that of other business units in different locations through the use of spend analysis. Thus, comparisons can be made, which can be used to make important decisions in the future. A central repository for spend information allows one to see which vendors generate the most revenue.

- Future Profitability

One of the most important benefits of spend analysis is the capacity to forecast expenditures. The data can be used by a variety of departments inside the firm to anticipate future expenses.

Spend data can be used to understand recurring vendor spending and long-term contracts, for example, to anticipate the next few years’ budgets for expenses in finance and planning departments.

- Mitigating Risk

One of the most important responsibilities of procurement is to minimize disruptions in the supply chain. It is possible to determine single-source purchases and build a strong supplier base to ensure crucial commodities are always available.

Combining supplier data with external sources allows you to identify the parts of your budget that are spent with suppliers who have poor credit ratings.

- Compliance

According to industry standards or laws, the organization may be compelled to follow particular auditing methods. A consolidated database with all necessary data, from supplier information to purchasing history, will ensure that staff comply with corporate regulations, and audits will go smoothly.

- Reduced Cycle Times

Managed spending allows for more efficient decision making, such as choosing the right suppliers and negotiating contract terms. Almost every transaction in a company has a different cycle time. To assist regularize recurrent operations like supplier selection or contract approval, spend management establishes a set of KPIs and ground rules to guide the actions. As a result, alternatives are narrowed and judgments can be made more quickly.

CHALLENGES AHEAD

- Lack of Resources

It is a full-time job for purchasing teams in firms to keep up with everyday responsibilities such as buying and supplier management, purchase order processing, etc. When it comes to spending, it takes a devoted effort to discover, compile, analyze, and execute frequently. Despite the fact that the company’s demand for IT support has decreased, it still has to devote resources to strategic sourcing and spend analysis in order to increase efficiency.

- Inconsistent Data

Consistencies, typos, and other errors abound in human entry of spending data. As a result, data sets with different currencies from different time periods and fluctuating exchange rates lead to complications and, eventually, irregular entries. As a result of inaccurate data, poor decision-making leads to increased costs.

- Lack Of Collaborative Initiative

Since category managers often purchase the same item for different purposes and don’t communicate with one other, they are likely to be unaware of each other’s spending habits. To that end, each department stores its information in a distinct format, based on the diverse purposes for which it is being used.

- Lack Of Analytical Skills

When it comes to companies dealing with smaller amounts of data, the talent pool of data analysts is smaller and requires a large financial commitment. In spite of the fact that there are no immediate and apparent outcomes, it can be tough to convince people to invest in analytical talents.

- Lack Of Support From Authorities

Diverse department chiefs are in charge of overseeing how much money is spent across departments. People with access to departmental data have various interests, attitudes, and levels of cooperation when it comes to collecting this data. Out of all of this, there is the possibility that inconsistent accounts of spending in different formats are incomplete, inaccurate or even incorrect.

SPEND ANALYSIS – Process

With any form of spend analysis, the most important part is the process itself, which can take six or seven steps, depending on the organization conducting the analysis. Procurement and spend analysis are well-known for their complexity and wide range of applications. For any organization, there isn’t a single procedure, aim, or strategy that works best. The analysis can be approached in various ways.

SPEND CUBE

It is a multi-dimensional cube that helps analyze spend data. Each axis represents different information.

CATEGORY ANALYSIS- types of goods/service purchased

COST CENTER ANALYSIS- functions/departments driving demand

SUPPLY ANALYSIS- suppliers from whom purchases are made

This data when stitched together provides insights and aids in making strategic decisions. With this information, you can select which high-spending end users to align with, and which suppliers to renegotiate with.

COURSE OF ACTION

- Tail Spend Analysis

Unmanaged tail spend makes company’s susceptible to risks due to the lack of awareness about the suppliers. There are ‘maverick’ high-cost purchases that ideally should have gone through a more strategic purchasing process in that 20 % of spend. It also means that companies may be doing business with suppliers who violate their own CSR principles, if for example, a vendor is using child labour or polluting the environment. The potential cost savings are significant. According to a recent Hackett Group study, over 27 % of companies reported savings of 5 % to 10%, with 30% reporting savings of at least 10%.

- Vendor Spend Analysis

When analyzing vendor expenditure, it is determined how much of the budget is spent on the most critical vendors. Use historical data to create an in-depth profile of each vendor’s spending. So, focusing efforts on getting the best value from these favored vendors and simplifying connections will be easier.

Consolidation and compliance possibilities are identified in order to maximize the use of spend data. Vendor, category, geography, etc. are just a few of the ways it helps illustrate spend insights for data-driven decisions.- Category Spend Analysis

Using the Category Spend Analysis, one can dive down to identify per-item trends statistics, pricing accuracy, and optimize savings. The data is easier to access, comprehend, and understand when spending is regularly allocated to different categories of expenses. To secure more favorable contracts and pricing, prioritization will allow better negotiations for major spend categories.

- Item Spend Analysis

It’s possible to look at the spending in terms of each individual item/SKU that the firm purchases. Many products come from many vendors, or they may be purchased by different departments. This method will uncover any wasteful or inefficient spending patterns.

- Payment Term Spend Analysis

A payment term spend study can help firms better understand their purchase to pay (P2P) processes by analyzing payment behavior and terms. The timing of payments can be equally as important as the composition of a company’s spending profile. Some companies give discounts to customers who pay their invoices in full before the deadline. This method helps take advantage of such opportunities.

- Control Spend Analysis

Losses for the company might also be caused by non-compliant contract terms. As a result of noncompliance, some analysts scrutinize the contracts of each vendor in order to uncover leaks. As a result, the finest contract arrangements for each supplier have been reached, and all of the buyers are purchasing from favored suppliers.

KPIs TO LOOK OUT FOR

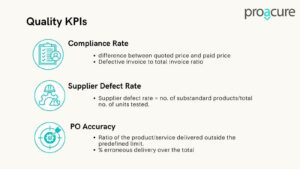

Quality KPIs

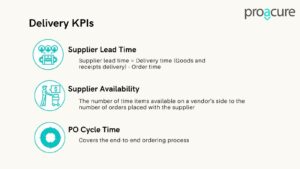

Delivery KPIs

Cost Saving KPIs

Businesses must use digital monitoring and KPI metrics to improve procurement. It will be much easier for companies to acquire and organize data if they use a cloud-based application.

Recognizing the need of measuring procurement KPIs is a crucial first step in improving procurement efficiency. The procurement department’s efficiency and effectiveness may be measured using procurement KPIs. It is possible for procurement managers to enhance their procurement strategy by keeping tabs on key procurement performance indicators. Developing procurement KPIs for a firm isn’t always a straightforward task. However, when procurement executives understand the nature of procurement KPIs, they can easily choose those that are in accordance with the company’s goals. A cloud-based digital procurement system may assist companies in tracking key performance indicators (KPIs), reduce risks and maximize cost savings.

COMPONENTS OF SPEND ANALYSIS

Descriptive- Traditional Approach

When it comes to Spend Analysis, the most typically employed element is the descriptive. As a whole, it’s a description. One can see how much is being spent by different business units, in what location and across how many transactions. User insight and data gathering are required to turn data into information.

With limited resources, the usual technique is OLAP (Online Analytical Processing), which allows for multidimensional data analysis and complex calculations to be considered. Many commercial applications rely on OLAP, which gives end-users the ability to perform ad-hoc analysis of data in various dimensions, allowing for decision making.

Descriptive analysis tends to be retrospective in nature. However, it tends to focus on the past and all future insights must come from the person who is doing it. Due to its reliance on physical labor, it is not as effective as intended. Reason being is that many efforts based on those findings span over a long period of time, which makes them difficult to implement quickly. Inevitably, over time, the desire to continue that initiative will simply fade away, if at all.

This only provides a rough roadmap for spending in the short term future unless other variables are added.

Prescriptive

If one wants to anticipate the future, you can use prescriptive analytics. Prescriptive analytics uses comparable modeling structures to predict outcomes before combining machine learning, artificial intelligence (AI), and algorithms. It then recommends the best possible course of actions, based on its findings.

In this case, the technology complements the individual’s intelligence by allowing them to generate insights straight from the data that is being supplied into it. Initiatives that originate from such an analysis are often well-accepted.

Intelligence itself is a hurdle in this case. The way firms operate differs among industries, countries, and business units, among others. As a result of this, it is nearly impossible to prescribe the same medication for all diseases.

Predictive- Advance Analytics Tools

It is an important component of spend forecasting, which attempts to give the best possible strategic sourcing decisions by analyzing historical data patterns, present situations, and predictive analytics to make the best possible strategic sourcing decisions.

As far as analytical methods go, predictive style is at the top of the list. In addition to processing historical data and trying to make sense of it, it also entails extrapolating data into the future and taking required preventive actions. As a result, the accuracy of the extrapolation is usually the main issue. A high level of statistical expertise is required because the future cannot be anticipated with 100% accuracy. As part of its work, the trend analysis team looks for irregularities in financial accounts, analyses and establishes overall growth, and identifies patterns as well as discrepancies that may suggest deeper problems.

For internal operations, trend analysis identifies expenses of conducting business, recurring spend and performance trends, as well as places where value and savings can be recovered or even expanded through a trend reverse.

Forecasting abilities are what make trend analysis so valuable; nevertheless, the accuracy of predictions is only as good as the data available (consumer habits, market data or past performance), as well as the tool used. With the help of modern analytical tools it’s now feasible to organize and analyze enormous data sets in real time, enhancing insights and forecasts’ accuracy and usefulness.

SPEND FORECASTING

Forecast is a business technique that analyses previous data to predict future patterns and results. It is also known as “business or financial prediction”. Forecasts help a firm make decisions about funding, product development, and consumer appeal. Forecasts are used by businesses to estimate how their operations, client reach, and profitability will appear in the future at a point. While most forecasts generate estimates for the following year, companies can create forecasts for up to many years in the future.

Spend Analysis and Spend Forecasting go hand in hand since procurement spend is studied to reduce spending, boost efficiency, or strengthen supplier relationships.

TREND ANALYSIS’ ROLE IN FORECASTING

Using predictive analytic tools, spend forecasting helps procurement teams secure raw materials, goods and services at the appropriate rates from the right vendors at the right times. With other new technologies like artificial intelligence and process automation, spend forecasting allows firms to identify and exploit insights .

Demand Forecasting

Using multiple data sources, such as stock market trends, market intelligence, and external events such as regulatory changes, global economic disruptions, and natural disasters, demand forecasting attempts to determine the impact on demand and the ways in which the unit price for any purchase will be affected over a given period of time.

It facilitates the comparison of current needs with future demand and price variation. Demand forecasting makes it easier to make sourcing decisions that will protect you from current and future expenses while also producing value through supply chain optimization .

Cost Forecasting

As a result of planning ahead, you may keep prices down. With the use of trend analysis, you can rapidly identify areas in which you must make timely investments in order to avoid rising expenses as well as areas in which costs are flat or declining, freeing up additional cash.

Cost analysis and forecasting in these areas make it simpler to source intelligently, create budgets, and maintain enough cash flow for an agile reaction to unanticipated expenditures and opportunities.. As a result, it is able to create cost models for tomorrow and determine which categories and goods should be procured in comparison to what should have been procured last year.

Currency Forecasting

As a result of neglecting possible currency fluctuations in both short-term and long-term sourcing and expenditure management, your hard-won contracts might be lost in a matter of days. Through more regular forecasting (e.g., quarterly instead of yearly), as well as making modifications when necessary, you may improve your sourcing strategy and keep costs low while avoiding supply chain disruptions, maintaining business continuity, and assuring business continuity.

When you diversify your supply chain and buy from the finest available suppliers in the correct currency, you may increase your overall profitability and supplier relationships.

INVOICE ANALYSIS ROLE IN FORECASTING

False payments, Duplicate payments, lost discounts, wrongful entry of transactions lead to an increase in the costs of manpower for manual three-way matching, data entry, and chasing exceptions without proper management, invoices can cost you big in both immediate costs and lost value.

Spend analysis tools can help you use invoices for spend forecasting. With this, we can gain more discounts, eliminate rogue spending and fraud, and free up your team to focus on strategic tasks—lowering costs and plugging the leaks in both your revenue and value streams.

Any unusual or unexpected purchasing behavior that falls outside existing spending patterns can also provide an opportunity to revisit your other analyses—cost, currency, demand—to identify opportunities to integrate these new categories into your supply chain management, business continuity management, and overall business process management plans.

Common problems of overpayment in an average Firm:

Fake Invoice Prints

The most common type of overpayment occurs when a supplier invoice is not paid on time for whatever reason and the supplier re-sends the invoice, which gets re-entered and queued for payment.Overpayment For Faulty Goods

The warehouse rejects defective goods, or accepts goods from an end customer that comes under warranty, and returns them to the supplier that is supposed to credit the organization.False Payment

The organization gets a seemingly valid invoice from a seemingly known supplier which is fraudulent either because a valid supplier(unintentionally) re-sent an invoice with a different invoice number or a fraudulent party sent an invoice attempting to mimic a valid supplier.If the invoices are associated with POs, and, in particular, POs associated with a contract, then the POs are issued according to a schedule defined by the contract. In this case, they have no predictive capability beyond the contract as they were defined by such a contract. And the invoices without a PO can be an even better indicator of emerging spend areas. If the organization keeps seeing spend across suppliers for a new type of service, it can be a leading indicator of a change coming down the pipe as the organization transitions to new product lines that need to be supported by new services. And if it sees new products, that could indicate changes in production line technology or back-office equipment that will soon be standardized and allow Procurement to get involved early, even before the organizational departments realize that they need Procurement’s support.

SHOULD COST MODELING

Demand shifts, a scarcity of resources, and inflation have all contributed to higher production and procurement costs. As a result, businesses have become more adept at analyzing costs and assessing supplier cost bids. Should-cost analysis will assist in providing a comprehensive breakdown of total costs where trend analysis might falter.

One may not have the full historic data sufficient to get an accurate trend analysis as cost can be affected by a number of variables not just limited to market price of material, labor, etc. If the suppliers can provide data regarding the factors affecting their pricing, should cost model integrated with analytics can lead to the following insights-

- Identifying the product’s major cost drivers and aiding in choosing a different production methodology.

- The analytics platform can automatically compute the average overhead percentage and identify the products for which an alternative might be required.

- Should-cost analysis gives the sourcing team a greater understanding of the profit margins of the supplier.

- Infer pricing comparisons of the item, assembly, if it is outsourced to multiple geographical areas.

- Using should-cost analysis in strategic sourcing will help one negotiate better deals and better understand supplier quotients.

- It also assists the new product development team in assessing the cost of the product early on.

MARKET & SUPPLIER INTELLIGENCE- PAVING THE WAY TO STRATEGIC SOURCING

According to a recent Aberdeen research report, procurement organizations are being pushed to better manage their supplier data by business imperatives like the corporate mandate to reduce costs, increased pressure on regulatory and internal compliance with contracts, and the need to simplify source-to-payment processes.

Digital technologies, such as on-demand market intelligence portals, social media platforms, enable a two-way flow of information that empowers procurement teams to increase their knowledge and awareness of supplier capabilities and associated market information. This helps procurement teams, among other things, develop closer connections with suppliers, forecast or plan for disruptions in the supply chain, and improve contract negotiations.

The real-time pricing of commodities is referred to as Market Intelligence. Volatility in the market causes changes in commodity prices. In order to arrive at a suitable solution that may create value for the company, technology can collect expenditure data and intelligence information and make a better educated and relevant choice.

Information regarding the reliability of a supplier is known as Supplier Intelligence. This includes parameters such as :

- supplier’s past performance in terms of on-time delivery, discounts,

- market trends

- the supplier’s competitive position in comparison to its peers

- regulatory and compliance reports

- Geopolitical environment, or any other factor that affects the performance.

Supplementing spend data with market and supplier intelligence can help maximize value. Procurement teams must use it to assess their purchases on a regular basis and take advantage of strategic sourcing. This implies that procurement plans should routinely be shaped based on input from suppliers.

The company’s advantage is if the material is sourced at the most advantageous prices and delivery times from a reliable supplier. An unwise selection of a supplier can adversely impact the company’s manufacturing process and its bottom line. To get the deal at the most favorable price, the procurement team must be aware of the market trends in the market. It is only when the cost, labor, transportation, and other cost components are factored in that the procurement team can lead to a better negotiable and realistic price.

The sourcing of materials on time and at the best rates, all the while always minimizing costs, is the procurement responsibility. Since the time and costs involved at this stage will impact the rest of the company’s manufacturing processes directly, decisions made at this stage are critical. As the procurement decisions are based on the procurement market intelligence report, this report is vital. So, a company’s attention to procurement market intelligence is significant to the company’s overall health.

Market intelligence is necessary to help tackle any aspect of most of these challenges. A procurement organization will be able to alleviate a good amount of its business pain by gathering data on supply market capabilities, getting a good read on how the competition is developing and managing its supply base and supply chain, and understanding key trends driving or otherwise affecting the market— ultimately synthesizing it all for strategic purposes.

AI CHANGES THE PARADIGM IN SPEND ANALYSIS

AI And Machine Learning

Machine learning has revolutionized the categorization of expenditure data. In addition to speeding up the process of obtaining spend data, machine learning algorithms can improve their accuracy and reduce the need for manual inputs. By absorbing semi-structured data and other material, AI can unlock new caches of data that go beyond transactional information.

Expanding spend analysis’ involvement in strategic sourcing would be a more logical approach to take. When procurement uses the newest machine learning technologies for data gathering, cleaning, and categorization, it can run expenditure analysis reports before, during and after a procurement event, giving them an even more comprehensive view.

AI assists procurement executives in identifying new market possibilities, tracking exchange rate volatility, and managing risks, according to the company’s website. Artificial intelligence-based procurement solutions have become increasingly popular as a result of this.

SPEND CLASSIFICATION-

ML plays a critical role when it comes to classifying spend. The major techniques are-

- Supervised classification

It’s a machine learning method that uses labeled datasets to guide the learning process. Those datasets are used to “train” algorithms so that they can categorize data accurately or make accurate predictions about outcomes. Inputs and outputs that are labeled allow the model to monitor its accuracy as well as learn over time.

- Unsupervised learning

Data sets without labels are analyzed and clustered using machine learning techniques. Human intervention isn’t required for these algorithms to uncover hidden patterns in data.

- Reinforced Learning

Reinforcement learning is a machine learning training method that rewards positive behavior while punishing undesired ones. It is generally accepted that reinforcement learning agents have the capability of perceiving and understanding their environment, performing actions, and learning from their mistakes.

As long as a reward can be clearly established this technique will pay off.

According to an article published by Forbes, 97% of enterprises say all their employees now work from home, escalating the need for cloud-based self-service BI and collaborative BI applications and tools. This will be a significant climb in the industry’s flight to automation of supply chains and procurement which also has an additional environmental benefit for the firms involved. Analytics and BI are being extensively used in strategic planning and sourcing to turn around the damage caused by the pandemic. Dresner Advisory Services’ research team are of the opinion that most enterprises are taking a data-driven approach to traverse through this crisis while heavily relying on analytics and BI to help identify potential alternative strategies and solutions.CONCLUSION

It is becoming increasingly important for procurement to play a strategic role in the firm, and spend analysis is a key strategic approach. While there are manual ways for acquiring and assessing procurement market data, the truth is that many organizations across a wide range of sectors have common problems that may be handled by automated procedures. Because of timely and reliable knowledge, organizations are better able to judge potential new suppliers as well as current ones. Because of automation, they’ve been able to save money, reduce their exposure to risk, and accomplish other significant goals.Saving to invest in opportunities is the ultimate goal for growth and Proacure helps to discover opportunities and insights for savings, compliance, diversity, innovation and more. Sourcing goals become easier to achieve with targeted opportunities, estimated financial impact and ease of implementation. Procurement experts must investigate how their departments receive and interpret market data to determine if they can do better.

Proacure is a procurement technology & data-science organization based in the San Francisco Bay Area. Our ‘Koreografy’ model leverages multiple frameworks like congruence of different data sets, fusion of digital, analytics and business processes, and synchronous collaboration between various stakeholders. The model enables 100% Spend Visibility with prescriptive actionable insights to transform Strategic Sourcing and help realize untapped value in the Supplier and Tail Spend. Proacure’s deliverables include cost savings of 7-30%, a 20%+ increase in EBITDA, cash flow optimization, and reduced supply-chain disruption.

Related Articles